The web changed my life. I can't live without wikipedia or Google. But ultimately, I'm disappointed. Almost every day, the web lets me down.

What do web users do for a living? What do we get paid to do that makes it worth giving us a web browser? Me, I make connections. I take disparate ideas and connect them in (hopefully) useful ways. Others do it with people, or cash instead of ideas. But we're all connectors.

Tim O'Reilly coined the term

Web 2.0. It is a bit controversial, but basically it describes a generation of web pages that go beyond the flat HTML of the original Web. Web 2.0 pages encourage community and user-generated content.

Web 3 is the brainchild of Tim Berners-Lee, largely credited for inventing the world wide web in the first place. It's more commonly called the Semantic Web. The idea is, to quote Lee, "I have a dream for the Web [in which computers] become capable of analyzing all the data on the Web – the content, links, and transactions between people and computers. A ‘Semantic Web’, which should make this possible, has yet to emerge, but when it does, the day-to-day mechanisms of trade, bureaucracy and our daily lives will be handled by machines talking to machines. The ‘intelligent agents’ people have touted for ages will finally materialize."

I'll get in trouble for this simple shorthand, but it's data about data. Websites that are smart about what they are and what they contain. But what's it for? I mean it's very audacious and powerful, but why? And what drives it to work?

The opportunities of the semantic web are limitless, and I can't wait. But that's not Web4. Web4 is what I'm really waiting for. And it's entirely possible that Web4 will get here before the semantic web even though Web 3 makes it work a lot better.

We start with this:

Ubiquity

Identity

Connection

We need ubiquity to build Web4, because it is about activity, not just data, and most human activity takes place offline.

We need identity to build Web4, because the deliverable is based on who you are and what you do and what you need.

And we need connection to build Web4, because you're nothing without the rest of us.

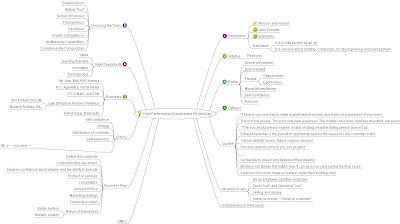

Web4 is about making connections, about serendipity and about the network taking initiative.

Some deliberately provocative examples:

I'm typing an email to someone, and we're brainstorming about doing a business development deal with Apple. A little window pops up and lets me know that David over in our Tucscon office is already having a similar conversation with Apple and perhaps we should coordinate.

I'm booked on a flight from Toledo to Seattle. It's cancelled. My phone knows that I'm on the flight, knows that it's cancelled and knows what flights I should consider instead. It uses semantic data but it also has permission to interrupt me and tell me about it. Much more important, it knows what my colleagues are doing in response to this event and tells me. 'Follow me' gets a lot easier.

Google watches what I search. It watches what other people like me search. Every day, it shows me things I ought to be searching for that I'm not. And it introduces me to people who are searching for what I'm searching for.

As a project manager, my computer knows my flow chart and dependencies for what we're working on. And so does the computer of every person on the project, inside my team and out. As soon as something goes wrong (or right) the entire chart updates.

I'm late for a dinner. My GPS phone knows this (because it has my calendar, my location, and the traffic status). So, it tells me, and then it alerts the people who are waiting for me.

I visit a blog for the first time. My browser knows what sort of stories I am interested in and shows me highlights of the new blog based on that history.

I can invest in stocks as part of a team, a team that gains strength as it grows in size.

Here's

Rikard's riff on how the iPhone could be more like Web4.

I'm about to buy something from a vendor (in a store with a smart card or online). At the last minute, Web4 jumps in and asks if I want it cheaper, or if I want it from a vendor with a better reputation. Not based on some gamed system, but based on what a small trusted circle believes.

My PDA knows I'm going to a convention. Based on my email logs, it recommends who I ought to see while I'm there--because my friends have opted in to our network and we're in sync.

I can fly to the CES for half price, because Web4 finds enough of us that we can charter a flight.

I don't have to wait for Rickie Lee Jones to come to town. Sonos knows who the Rickie Lee fans are, and makes it easy for us to get together and initiate a concert... we book her, no scalpers necessary.

I don't get company spam any more ("fill out your TPS reports") because whenever anyone in my group of extended colleagues highlights a piece of corporate spam, it's gone for all of us. But wait, it's also smart enough that when a recipient highlights a mail as worth reading, it goes to the top of my queue. If, over time, the system senses (from how long I read the mail, or that I delete it, or that I don't take action) that the guy's recommendations are lame, he loses cred.

Sure, it sounds a bit like LinkedIn. But it's not. LinkedIn tends to make networks that are sprawling and weak. Web4 is about smaller, far more intense connections with trusted colleagues and their activities. It's a tribe.

You don't have to join a tribe. But if you did, would you be more successful?

Unlike Web 3, we don't need every single page in the world to be 'compliant.' What we need is:

an email client that is smart about what I'm doing and what my opted in colleagues are doing. Once that gains traction, plenty of vendors will work to integrate with it.

a cell phone and cell phone provider that is not only a phone.

a word processor that knows about everything I've written and what's on the web that's related to what I'm writing now.

moves by Google and Yahoo and others to make it easy for us to become non-anonymous, all the time, everywhere we go.

This stuff creeps some people out. The thing is, privacy is an illusion. You think you have privacy, but the video surveillance firms and your credit card company disagree. If we're already on camera, we might as well get some benefits from it. If we choose.

I think it's fascinating that Web4 is coming from the edges (we see all sorts of tribal activities popping up in blogs, communities, rankings, Digg, etc.) as opposed to from the center. Web 2.0 happened in largely the same way. Even online, big organizations seem to have the most trouble innovating in ways that change the game.